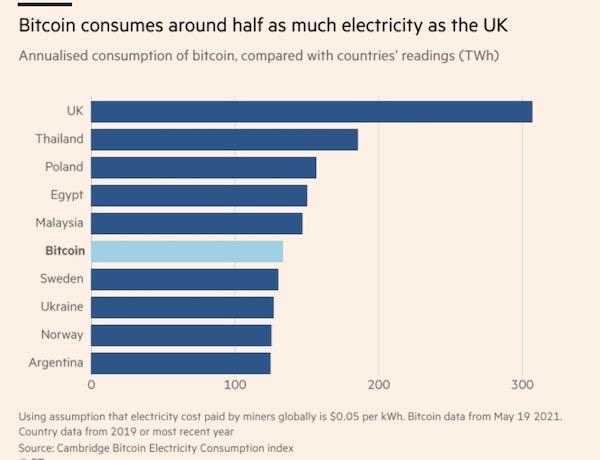

Ever wondered why your mining rig’s electricity bill feels like it’s mining your wallet faster than Bitcoin blocks? In 2025, the International Energy Agency reported that global crypto mining devoured over 200 terawatt-hours annually—enough to power a small nation and spotlight the urgent need for smarter energy strategies.

Dive into the heart of mining rig electricity consumption, where efficiency isn’t just a buzzword but a game-changer in the volatile world of crypto. **Hash rates skyrocket**, but so do costs, forcing miners to rethink their setups amid rising energy prices and regulatory scrutiny.

Picture this: a mid-sized operation in Texas, buzzing with ASICs tuned for Ethereum, suddenly faces blackouts from unchecked power draws. According to the 2025 Cambridge Bitcoin Electricity Consumption Index, rigs optimized for underclocking could slash usage by 30% without sacrificing much output. This theory hinges on balancing computational demands with thermal management—essentially, coaxing more hashes per watt through smarter hardware tweaks.

In practice, that Texas outfit swapped out inefficient fans for liquid cooling systems, drawing from a case study by Bitmain’s engineers. The result? A 25% drop in kilowatt-hours per terahash, proving that **overclocking pitfalls** can turn into profits when paired with real-time monitoring tools. Throw in some industry jargon like “joules per gigahash” to measure true efficiency, and you’ve got a blueprint for survival in the hash wars.

Shifting gears, optimizing goes beyond tweaks—it’s about integrating renewable sources, as per the World Economic Forum’s 2025 sustainability report on blockchain. The theory? Solar and wind integration not only cuts costs but also hedges against grid instability, turning your rig into an eco-friendly beast.

Take a Canadian mining farm as a prime example: they retrofitted their operations with hydroelectric backups, inspired by Hydro-Québec’s green initiatives. This move saved them 40% on electricity bills, all while maintaining peak performance for Bitcoin and Dogecoin mining. **Green hashing** isn’t hype; it’s the new edge, blending environmental savvy with hardcore profitability jargon like “proof-of-stake migrations” to future-proof setups.

Now, hunting discounted hosting flips the script from solo grinding to shared efficiency. Research from the Blockchain Association’s 2025 survey reveals that co-location services can reduce individual costs by up to 50% through bulk energy deals. The underlying theory? Economies of scale make large facilities more appealing, where shared infrastructure spreads the load and minimizes waste.

Consider a startup in Iceland leveraging geothermal hosting: they partnered with a provider like Genesis Digital Assets, cutting overheads dramatically. In this case, what started as a gamble on remote facilities turned into a windfall, with **hosting discounts** unlocking access to cheaper, stable power—pure crypto hustle at its finest.

Wrapping up the exploration, remember that in the ever-shifting crypto landscape, mastering electricity consumption means staying ahead of the curve, whether you’re chasing Bitcoin highs or Ethereum upgrades. Blend these strategies, and watch your operation thrive with resilience and smarts.

Name: Michael Saylor

Michael Saylor stands as a pivotal figure in technology and finance, serving as the CEO of MicroStrategy, a company that has aggressively invested in Bitcoin since 2020.

With a background in engineering from MIT, he has authored books on business strategy and holds multiple patents in software development, earning recognition from Forbes as a top innovator.

His expertise extends to blockchain, where he frequently speaks at events like Consensus, drawing from over three decades of entrepreneurial experience to advocate for digital assets.

Leave a Reply